“Pigs get fat, hogs get slaughtered. When you try to take it too far, people turn the other way. I’m just telling you, when you’ve got a good thing and you get greedy, it always, always, always, always, always turns on you. That’s rule No. 1 of business.” Mark Cuban, March 2014.

Xcel Energy is getting “hoggy,” if we apply Mark Cuban’s quote to the state’s largest monopoly utility.

The company wants more money…again. This time instead of building more capacity that ratepayers don’t need, they want to charge more for providing electricity service to ratepayers who have no choice but to pay the price.

According to the Denver Business Journal:

Xcel on Tuesday asked state regulators to raise electricity rates by a total of $244.9 million over the next four years, starting in 2018….

Xcel said it needs more money to pay for work to smooth the integration of renewable energy with traditional power plant fuels, increase the reliability of the grid, reduce energy costs and give customers more information to control their energy use and bills.

How can Xcel claim to “reduce energy costs” when ratepayers will be charged more? This sounds like a monopoly sleight of hand. “Energy costs” may go down, but the cost of transforming that energy into electricity actually goes up. In addition, ratepayers are already charged for putting “renewable” energy on to the grid through two line items — the RESA (Renewable Energy Standard Adjustment) and the ECA (Electric Commodity Adjustment) — on their electric bill.

Remember not so long ago we were told that Xcel could produce 30 percent of its electricity using predominantly industrial wind and keep it under the two percent rate cap. When the legislation was introduced in January 2010, then state representative Max Tyler (D-Lakewood) told the Colorado Independent:

…there’s a 2 percent [price] cap [on the 20 percent mandate imposed in 2007], and that’s not going to change. This will stabilize the costs to people because 30 percent of our electrical generation is going to be based on resources and supplies that are not going to fluctuate with the market.

Xcel Energy said:

‘Through our already filed compliance plan, our company anticipates we would be very close to a 30 percent level, within the current 2 percent rate cap,’ [Xcel spokesman Tom] Henley said. ‘As long as the cap on increased costs remains in place as protection for our customers, we are willing to consider increasing the standard.’

Xcel’s recent rate increase request is further proof that the so-called two percent “rate cap” really is a sham as we’ve said repeatedly in the face of Xcel, former Governor Bill Ritter and Tyler’s ridiculous claims to the contrary. Wind as a resource is free, but transforming it into electricity that is usable on a mass scale is expensive, and the costs keep going up.

For Xcel’s latest request DBJ provides some numbers:

The rate increase, as proposed by Xcel, would raise Colorado energy bills by an average of about 2 percent per year in 2018 through 2021…Over the course of four years, average monthly bills would rise by a total of $1.73 for residential customers and $2.68 for small-business customers.

Do the math. That’s an additional $32.16 per year for small business customers and $20.76 per year for residential ratepayers for something that is supposed to “reduce energy costs.” It’s laughable except that you and I have to pay the bill.

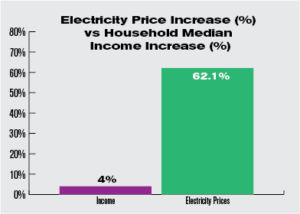

The monopoly is correct to claim that rates across Colorado (inside and outside of Xcel’s service area) have “dropped” in recent years as the Denver Post reported. However, the drop is merely a small blip on the skyrocketing rates trajectory of the last 15 years. Since 2001, Colorado electric rates have gone up 62.1 percent across all sectors.

Data analysis shows that electricity rates across all sectors (residential, commercial, and industrial) increased by an average of 62.1 percent between 2001 and 2016. For context, the average increase across all sectors for all Mountain states during the same period was 44.9 percent. The increase nationally was 41.1 percent. Colorado saw increases that were 17.2 and 21 percentage points higher than the mountain states and the United States respectively.

Furthermore, the decline is associated with a decline in the cost of natural gas and stability in the cost of coal. Something we recently documented here.

Across all sectors there was a marginal decrease in the cost of electricity between 2014 and 2016 of 0.30 cents per kilowatt hour or approximately 9 percent. This coincides with a decrease in the energy price index of 10.1 percent, which typically results in lower fuel costs for utilities and a lower cost of living for consumers. A key factor in the decrease of the energy price index was the price of natural gas as the Institute for Energy Research reported:

“Between 2005 and October of 2015… natural gas prices delivered to electric utilities declined by almost 60 percent and coal prices have remained essentially flat.”

Still, that decrease didn’t come close to narrowing the gap between the rise in Colorado electricity rates and median household income. In 2005 Colorado’s real median household income was $61,474 according to the Web site the Department of Numbers (which uses census figures), by 2015 this amount was only $63,909, an increase of only 4 percent. This disparity between median household income (2005-2015) and the rise is the cost of electricity (2001-2016) is shown more clearly in the graph below.

Xcel doesn’t need more money to provide electricity to Colorado ratepayers. For a monopoly whose customers have no choice and no voice, Xcel’s profits are obscene. William Yeatman of the Competitive Enterprise Institute and I revealed Xcel’s profits in our column about the company’s recently announced Colorado Energy Plan:

According to the company’s financial filings, Xcel’s asset value (on which it earns a 10 percent rate of return) increased $6.4 billion or 77 percent, profit per ratepayer increased nearly 77 percent as well, and Xcel’s annual profits nearly doubled from $458.8 million to $889.6 million.

Considering how much money the monopoly utility has made off the backs of Colorado ratepayers, it would a nice gesture if the PUC rejected Xcel’s request. It’s time for Xcel’s shareholders, who have a voting voice in how the company operates, to share some of the cost instead of just taking all the profit. Otherwise the time will come when ratepayers relish butchering Xcel the hog and turning it into bacon.