By Grant Mandigora

Executive Summary

In 2001, Colorado electricity consumers enjoyed some of the lowest electric rates in the country. The 15 years since haven’t been so kind to ratepayers. For more than a decade, elected officials, PUC commissioners, industry and advocates have told Colorado ratepayers that they could transform the state’s electricity generation away from coal and toward industrial wind, solar and natural gas with little cost to ratepayers. However, the actual numbers tell a much different story.

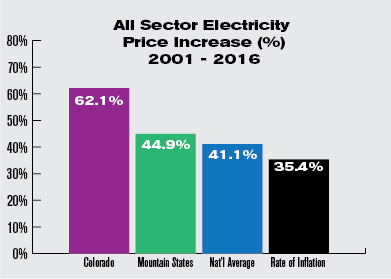

- Colorado electricity rates have risen sharply – 62.1 percent – across residential, commercial and industrial sectors, despite a slight decrease in recent years.

- Colorado electricity rates have increased 17.2 percentage points more than the Mountain state region (Arizona, Idaho, Montana, New Mexico, Nevada, Utah and Wyoming) collectively, where rates increased 44.9 percent over the same time period.

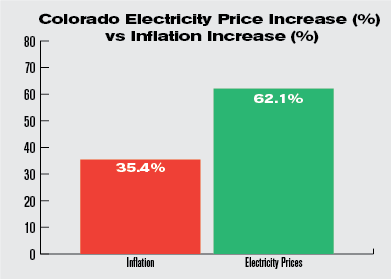

- The 62.1 percent increase is 1.75 times more than the cumulative rate of inflation at 35.4 percent.

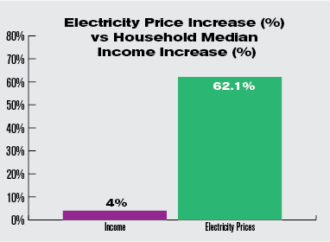

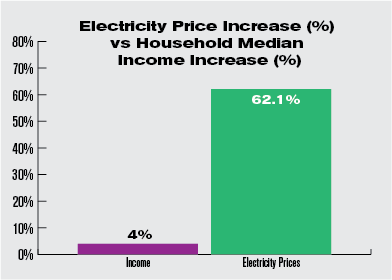

- The rise in electricity rates has outpaced the rise in household income which has averaged a meager four percent over the last 10 years.

- Public policy may be to blame in part. Colorado Public Utilities Commission (PUC) data suggests that in 2012, part of the dramatic increase was due to the renewable energy mandate.

Introduction

Since 2001, Centennial state ratepayers have been forced to endure a 62.1 percent electricity rate hike across all sectors. What happened in those 15 years?

The New Energy Economy (NEE), ushered in by one-term Democrat Governor Bill Ritter (2007-2010) and advanced by current Democrat Governor John Hickenlooper, is a spate of nearly 57 laws that transformed how the state generates and delivers power. Included in the NEE are mandates and programs such as 30 percent renewable energy standard, tripling of the original 10 percent mandate passed by voters in 2004; mandated fuel switching from coal to natural gas titled the “Clean Air, Clean Jobs Act,” and Demand-side management, where customers pay monopoly utilities not to produce electricity.

Following up on a March 2016 paper from then senior energy policy analyst Michael Sandoval, our current analysis shows a slight decline in recent years but still an overall trend of skyrocketing rates. We looked at each sector over the last 15 years and compared Colorado to other Mountain states and the impact on ratepayers.

Rising Electricity Rates

Data analysis shows that electricity rates across all sectors (residential, commercial, and industrial) increased by an average of 62.1 percent between 2001 and 2016. For context, the average increase across all sectors for all Mountain states during the same period was 44.9 percent. The increase nationally was 41.1 percent. Colorado saw increases that were 17.2 and 21 percentage points higher than the mountain states and the United States respectively.

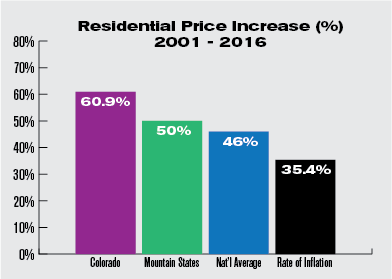

Colorado’s residential rates haven’t fared much better, increasing 60.9 percent over the last 15 years. While this increase isn’t the highest among Mountain states, it is nearly 11 percentage points higher than the collective 50 percent increase over the same time period, and 14.9 points higher than the U.S. average of 46 percent.

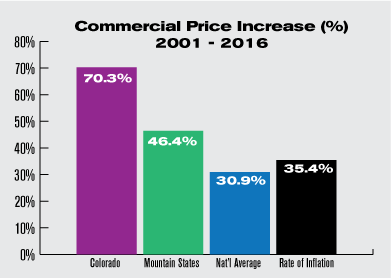

The rise in Colorado’s commercial electricity rates (usually defined as a smaller manufacturer or activity that produces a service) was an alarming 70.3 percent over the last 15 years. While the average across Mountain states was 46.4 percent and the U.S. average was 30.9 percent. Colorado’s increase is 23.6 percent more than its region and more than double the U.S. average.

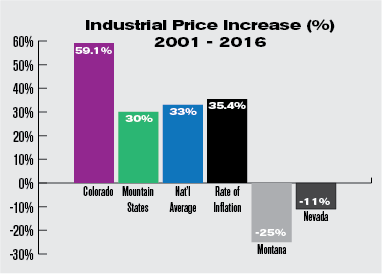

Colorado’s industrial rates (saved for larger industrial and commercial users) tell a similar tale having increased by 59.1 percent over the last 15 years. The Mountain state average during this same period has been 30 percent with the U.S. average approximately 33 percent. Again, Colorado’s rates have far outpaced the U.S. and Mountain state average considerably. As Colorado rates have risen, some states have seen a decline in particular Montana and Nevada rates have dropped by 25 and 11 percent respectively.

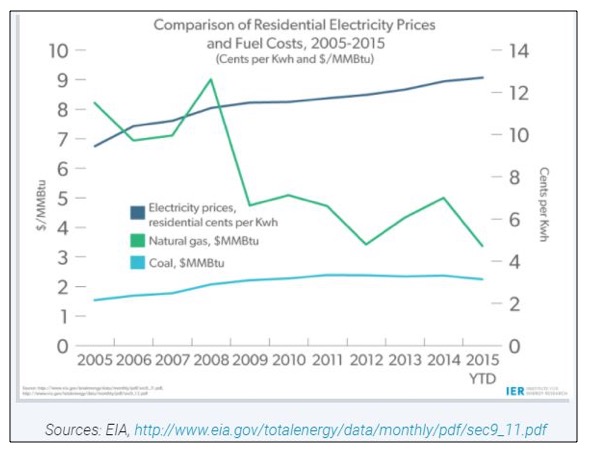

Across all sectors there was a marginal decrease in the cost of electricity between 2014 and 2016 of 0.30 cents per kilowatt hour or approximately 9 percent. This coincides with a decrease in the energy price index of 10.1 percent, which typically results in lower fuel costs for utilities and a lower cost of living for consumers. A key factor in the decrease of the energy price index was the price of natural gas as the Institute for Energy Research reported:

Between 2005 and October of 2015… natural gas prices delivered to electric utilities declined by almost 60 percent and coal prices have remained essentially flat.

Still, that decrease didn’t come close to narrowing the gap between the rise in Colorado electricity rates and median household income. In 2005 Colorado’s real median household income was $61,474 according to the Web site the Department of Numbers (which uses census figures), by 2015 this amount was only $63,909, an increase of only 4 percent. This disparity between median household income (2005-2015) and the rise is the cost of electricity (2001-2016) is shown more clearly in the graph below.

Editor’s Note: The St. Louis Federal Reserve shows Colorado’s real median household income grew at just over five percent between 2001 and 2016, from $66,964 to $70,566. All of that growth came in the last year because from 2001 to 2015, real median income was essentially flat — $66,964 in 2001 to $67,438 in 2015. The result is the same with either source. Growth in Colorado electricity rates has far outpaced growth in real median income.

U.S. cumulative inflation rate was 35.4 percent. That means the cost of powering Coloradans’ homes and the state’s economy has increased 1.75 times (nearly double) the rate of inflation as the graph below illustrates. That electricity prices have risen is no surprise, that the price has risen by 57 percent more than inflation is surprising.

The Why

We know from previous research that Colorado’s electric generation capacity is plentiful, in fact, Colorado has excess generation. With excess supply, what are rates low? The simple answer is public policy.

Governor Bill Ritter assured Coloradans that tripling the renewable mandate wouldn’t increase costs to consumers. Yet the Institute for Energy Research (IER) notes:

Colorado has higher electricity rates than most of its neighboring states: Colorado jumped from middle of the pack to second highest residential electricity prices in the Mountain West since the RPS was implemented. Additionally, Colorado Public Utilities Commission data show that the RPS was directly responsible for a 13 percent increase in Colorado’s electricity rates in 2012.

Additionally, IER in their study ‘The escalating cost of electricity’ explain the impact of regulations and mandates on Colorado rates:

Over the past 10 years, electricity prices have been going up, while over most of that time, the costs of coal and natural gas—the two major fuel inputs to electric generation—have declined or stayed relatively flat. This anomaly is caused by the growth of more expensive renewable energy (wind and solar power) and the onerous regulations that the Environmental Protection Agency (EPA) is forcing on electric utilities that require capital investments to be made to existing generators. This trend has occurred at both the national level and in states like Colorado, and has happened when U.S. electricity consumption has stayed relatively flat or even declined.

Impact on consumers

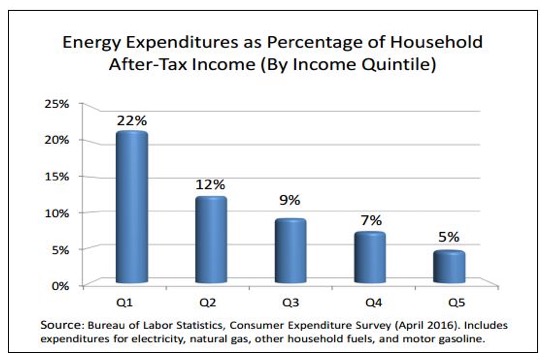

According to the American Coalition for Clean Coal Electricity (ACCCE) “In the U.S., energy costs eat between 5 and 22 percent of families’ total after-tax income, with the poorest Americans, or 25 million households, paying the highest of that range.”

Those in Quintile one (Q1) i.e. the poorest households on average spend 22 percent of their after-tax income on energy. The study found that increases in the cost of electricity disproportionately affect those in Q1. Their energy needs are generally inflexible therefore any increase in the cost of electricity means they must reduce spending in other basic necessities such as food and clothing.

In contrast, the U.S. average for household expenditure on energy is seven percent of after tax income. It is fair to say that the electricity price increases in Colorado have taken money from ratepayer’s pockets. ACCCE goes as far as saying these increases “…serve as an effective tax on households.“

Even Xcel acknowledges the challenge of high electricity rates on low income Coloradans and provides payment options for them.

Xcel, the state’s largest electricity utility, calculates monthly payments based on 3 percent of a household’s income.

Average households pay 2 percent to 3 percent for energy, compared with low-income households, which often pay as much as 50 percent.

‘That leaves very little for food, clothing, medicine,’ said Pat Boland, Xcel’s manager of customer policy and assistance.

Bottom line, Colorado’s public policy that has driven up electricity rates hurts the least among us.

Conclusion

Governor Ritter and other renewable energy advocates said the NEE in Colorado wouldn’t cost ratepayers more. A 62.1 percent electricity increase, over the last fifteen years, across all sectors, shows just how wrong they were. Over the same period, the price of natural gas has dropped an astonishing 79.3 percent, while the price of coal rose marginally by 0.6 percent. Ratepayers have not benefitted from the drop in prices and instead have had to contend with rising electricity prices.

The rise in prices has hurt low income families disproportionately, with most of their income being redirected from basic necessities to paying for power. At the same time, household median incomes across the state have barely risen. The legislative mandates imposed by the NEE have played a major role in the rise in prices. This begs the question, would Coloradans have supported the NEE had they known the cost upfront?

What is clear: ratepayers are the biggest losers when prices increase so drastically while incomes remain static.

Grant Mandigora is an energy policy intern at the Independence Institute, a free market think tank in Denver, and a master’s student in energy studies at the Jackson Institute for Global Affairs at Yale University.

Amy Cooke and Michael Sandoval contributed to this post.

Update: This post was updated to include an additional source on real median household income.

Additional resources

http://www.americaspower.org/wp-content/uploads/2016/06/Family-Energy-Costs-2016.pdf

https://thinkprogress.org/u-s-electricity-sales-dropped-in-2015-for-fifth-time-in-8-years-ac1050d3b800/

https://drive.google.com/file/d/0B0TNL0CtD9wXT0JqMV9jQkdOWTg/view

https://ycharts.com/indicators/energy_index_world_bank

https://www.eia.gov/todayinenergy/detail.php?id=26072

http://instituteforenergyresearch.org/analysis/the-escalating-cost-of-electricity/

http://www.deptofnumbers.com/income/colorado/

https://www.eia.gov/todayinenergy/detail.php?id=28412

http://usinflation.org/us-inflation-rate-calculator/

http://www.deptofnumbers.com/income/colorado/

https://coloradoencyclopedia.org/article/colorado%E2%80%99s-new-energy-economy

http://programs.dsireusa.org/system/program/detail/133

https://coloradomining.org/Content/Release_Pdf/CO_Release_10-01-10.pdf