Newly released federal government data offers insights into Colorado’s electricity sector last year.

The U.S. Energy Information Administration (EIA) recently published its latest Electric Power Monthly report with additional data gathered through December 2023. The data is preliminary and will continue to be refined by the agency until it releases its final Electric Power Annual report this October. Until that time, however, it offers the most comprehensive and up-to-date look at how Colorado’s electricity sector performed last year.

Here are some of the key takeaways about the state of Colorado’s electric grid in 2023.

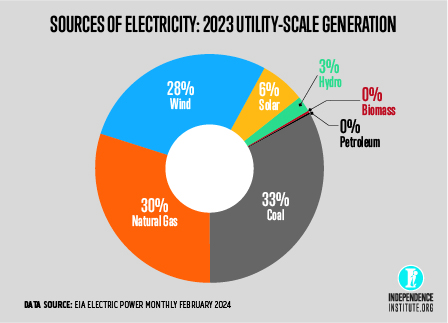

Generation

Coal was once again king for Colorado’s grid in 2023, representing a third of the state’s annual electricity generation—the single largest source on the year.

Its relative share of the state’s electricity mix did decrease from 2022, however, when it was 37 percent of the state’s annual electric generation. This decrease is likely due to the fact that two major coal plants—Unit 1 at Comanche Generation Station in Pueblo and Martin Drake in Colorado Springs—shut down at the end of 2022.

Natural gas was the second-largest source of annual electricity generation last year, producing over 17.1 Terrawatt hours (TWh), or 30 percent of the state’s electricity. That represents a sizeable increase from 2022, when natural gas represented approximately 26.7 percent of Colorado’s annual electricity.

Wind generation decreased slightly from 2022 to 2023, down roughly 5 percent from just under 17 TWh to just over 16 TWh. However, its relative share of Colorado’s annual generation remained relatively stable, at about 28 percent.

Solar saw a modest jump in its share of Colorado’s electricity mix thanks to several new utility-scale solar projects coming online in 2023. Output from Solar PV more than doubled and was responsible for over 6 percent of the state’s annual electricity generation.

Conventional hydro (1.3 TWh) and pumped-storage hydro (25 Gigawatt hours) together provided an additional ~3 percent of Colorado’s 2023 electricity, with a smattering of petroleum and biomass responsible for filling in the gaps.

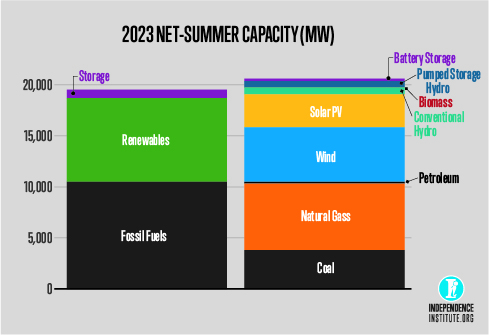

Net Summer Capacity

Colorado’s net summer capacity, defined as the maximum output its generating resources can supply to the grid during periods of summer peak demand, increased in 2023 compared with 2022.

The state’s 2023 net summer capacity was roughly 19.5 gigawatts (GW) versus 18.1 GW the previous year, driven almost entirely by new solar and battery storage as well as some gas additions. Fossil fuels were responsible for around 10.5 GW of that capacity, while renewables and storage provided the balance.

Colorado’s 2023 net summer capacity figures by specific resource were as follows:

- Natural Gas – 6,528.7 megawatts (MW)

- Wind – 5,336.7 MW

- Coal – 3,804 MW

- Utility-Scale Solar – 2,147.1 MW

- Distributed Solar – 1,085.3 MW

- Conventional Hydro – 689.7 MW

- Pumped Storage Hydro – 590.4 MW

- Battery Storage – 240.2 MW

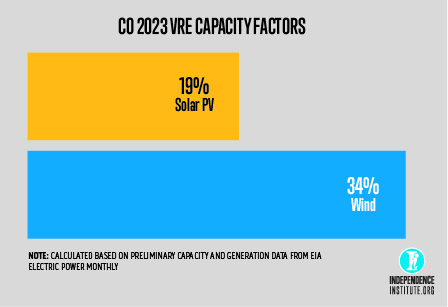

Annual Capacity Factors

An electric resource’s “capacity factor” refers to the ratio of electricity actually produced by a generating unit compared to the theoretical maximum it could have produced if it operated at continuous full power during a given period of time.

For example, a plant with a hypothetical 100 percent capacity factor would always produce full power.

Over the course of a given year, the average annual capacity factor of a resource tells us how often it actually produces usable energy as advertised by its nameplate capacity.

This is particularly important for intermittent or variable renewable energy (VRE) resources like wind and solar as they become increasingly responsible for Colorado’s energy supply because they cannot modulate their output to meet demand. They simply produce what they can when weather conditions permit.

For 2023, Colorado’s wind fleet had an average annual capacity factor of 34 percent, while the state’s solar resources had an average annual capacity factor of 19 percent.

These lower capacity factor figures help explain why wind, for example, had a lower share of Colorado’s annual electricity generation than coal in 2023 despite representing a much greater share of the state’s installed generation capacity.

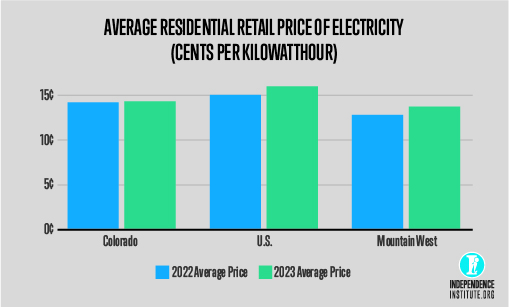

Average Electricity Prices

In 2023, the average retail price of electricity delivered to residential ratepayers was 14.32 cents per Kilowatt hour, slightly up from 14.19 ¢ / kWh in 2022.

Fortunately, Colorado’s average residential prices remained lower than the U.S. average of 15.98 ¢ / kWh in 2023. The state’s prices, however, remained higher than the average paid by residential customers in the broader eight-state Mountain West region and were higher than every other Mountain West state save for Nevada.