Imagine this scenario: The teacher has posted the grades for the final exam on the wall outside the classroom. There, standing and staring at the paper is a young student crying. “What’s the matter? Did you not get a passing grade?” the passerby asks. The weeping student, struggling for composure, simply shakes her head. “Then what’s wrong?”

Finally, the answer comes out. The student explains that she was sad not because she got a poor grade, but because she never got a chance to take the course, and thus received no grade at all.

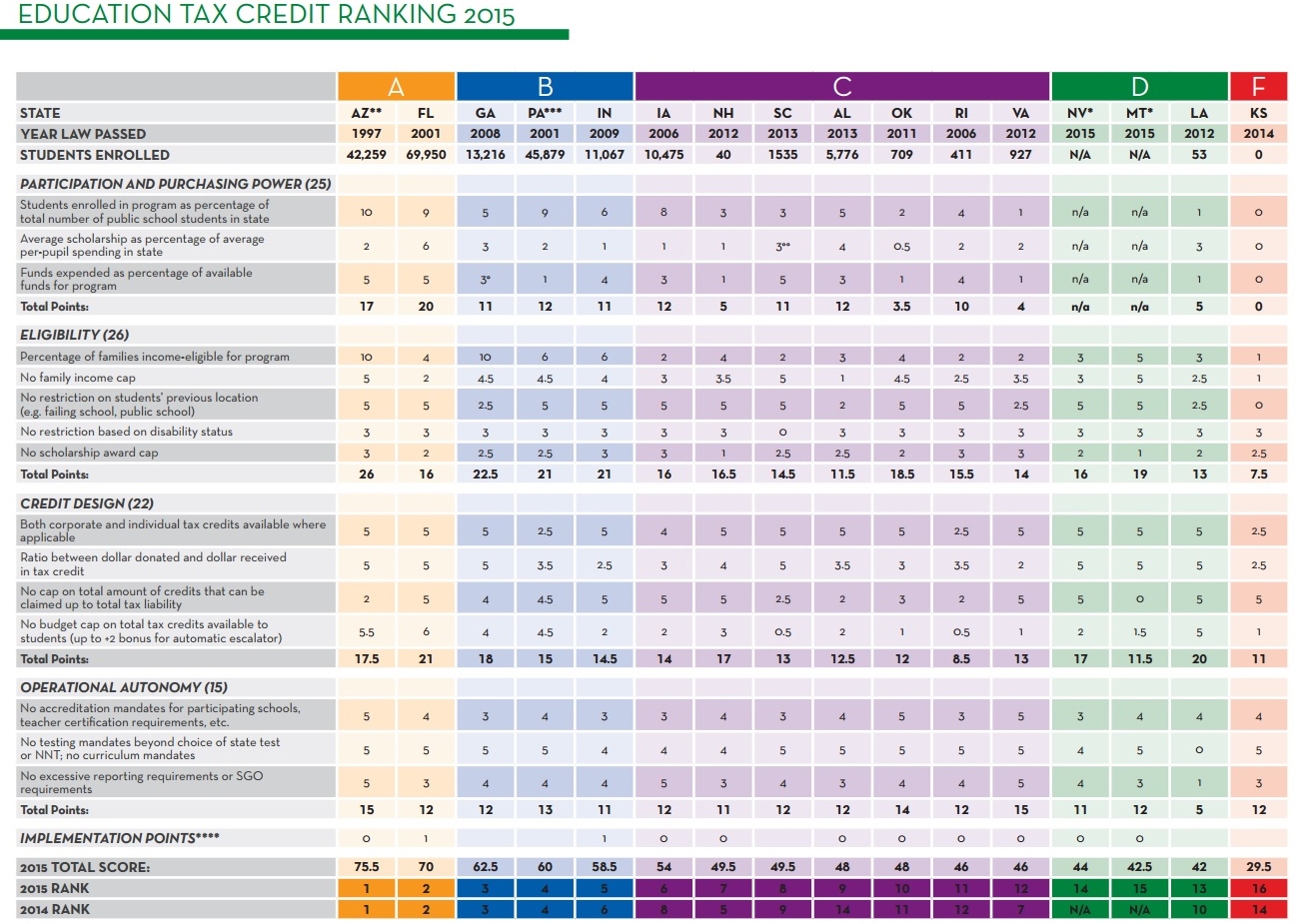

That’s kind of how I felt upon seeing the Center for Education Reform’s new Education Tax Credit Laws Across the States Ranking and Scorecard 2015.

Now don’t get me wrong. I love that, for the second straight year, the great folks at CER have taken it upon themselves to examine carefully all 16 different states with scholarship tax credit (STC) programs giving kids and families more options. (My Education Policy Center friends’ most recent report on scholarship tax credits only has 14 states — and while breaking down the details of the programs, doesn’t offer grades.)

First of all, it’s terrific to see two of the states with the oldest, most well-subscribed programs (Arizona and Florida) finish at the top of the heap with A grades, and to see what factors make their program most effective. Combined, these two states also happen to enroll more than half of the 200,000 or so students served nationwide by this increasingly popular form of school choice.

Other states excel in areas of specific design to their STC programs, such as:

- Georgia, which nets a perfect ’10′ for the percentage of families eligible to participate based on income

- Pennsylvania, Indiana, and seven other states win by having no restrictions on where a student was previously enrolled before receiving a scholarship

- Iowa Rhode Island, and Virginia, which model the policy of having no cap on scholarship amount

Finally, though, it’s a little concerning to observe that the five newest STC states, all adopted since 2013, have received a C or lower (Kansas’ 2014 program netting the only F). Yet Colorado glances eastward with a touch of envy and thinks: “At least they have passed a program. For the sake of thousands of kids in need, maybe someday we can, too.”

The message being satirized in this new Choice Media video might tell you otherwise:

A little freaky? A little scary? Yes. But I also had to chuckle.

Meanwhile, the American Federation of Children has brightened my week with news that the school choice program for needy kids in Washington, D.C., has been reintroduced in Congress. (Okay, I just had to mention it because this issue seems to repeat itself like deja vu all over again, and I’ve been covering it since I was 5 years old 7 years ago.)

Proving once again that, at least in the case of edublogging prodigies, it can be really hard to grow up. So if I keep crying until Colorado kids get their own scholarship tax credit program, maybe you can just give me a hug?