Corporate welfare has long been a feature of U.S. energy policy. A recent government report highlights how much that corporate welfare redounds to the benefit of wind and solar over the resources that form the backbone of the country’s energy economy.

The U.S. Energy Information Administration (EIA) released its latest Federal Financial Interventions and Subsidies in Energy report in August. The updated report tallied the amount of subsidies that the federal government provided energy producers between fiscal years (FY) 2016 and 2022. It found that nearly half (46 percent) of the $183.3 billion in taxpayer-funded energy subsidies over that period went to renewables, while just 15 percent went to traditional fuels like natural gas, coal, oil, and nuclear.

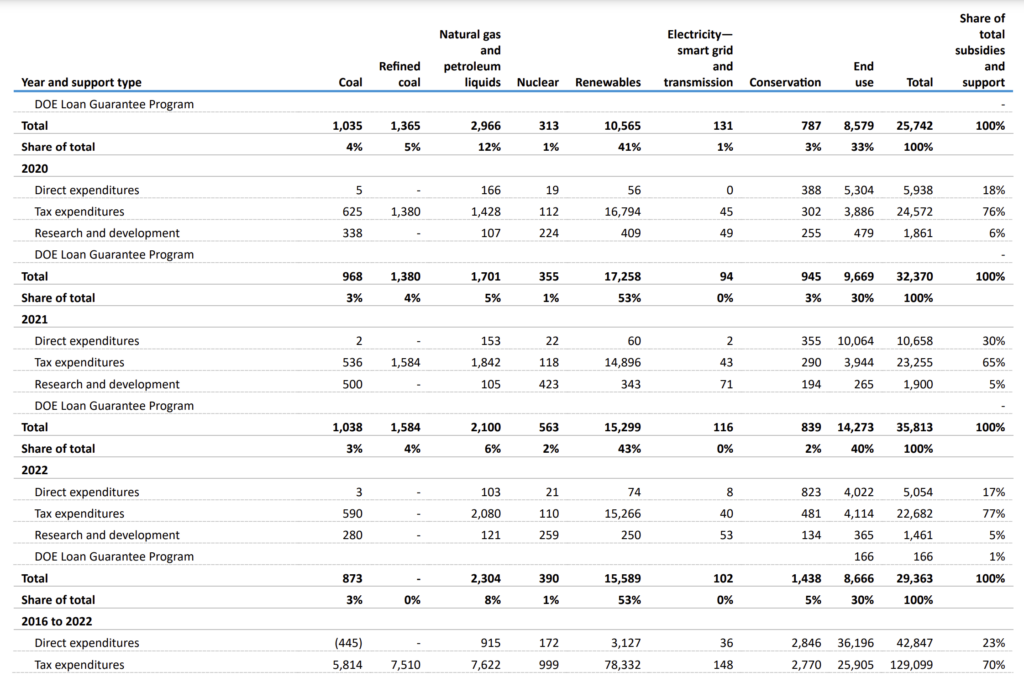

Renewable subsidies more than doubled over the period examined in the report, increasing to $15.6 billion in fiscal year 2022 from $7.4 billion in 2016. Fossil fuel-based energy resources were subsidized nearly five times less than renewables in the last fiscal year (~$3.2 billion), while nuclear producers received just $390 million–about 1 percent of the total subsidies doled out in 2022.

U.S. EIA. Quantified energy-specific subsidies and support by type, fiscal years 2020-2022 / Screenshot

The disparity in federal subsidies devoted to renewables is even more staggering when taking into account the amount of energy each resource produced last year.

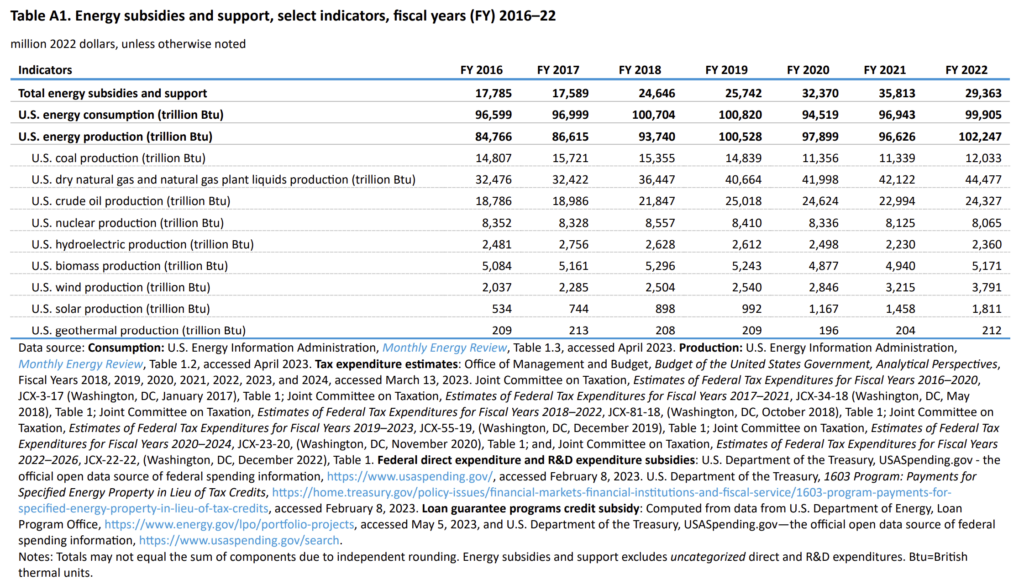

Fossil fuels produced approximately 80.8 quadrillion British thermal units of energy in 2022, according to the report, while renewables in all forms produced just 13.4 quadrillion Btus. That means on a dollars per unit of energy produced basis, renewables were subsidized 29 times more than fossil fuel-based energy in 2022.

Meanwhile, nuclear produced approximately 8.1 quadrillion Btus (or, roughly what wind, solar, hydro, and geothermal produced combined) yet received more than 23 times fewer subsidies on a dollars per unit of energy produced basis despite contributing reliable, carbon-free energy.

U.S. EIA. Energy subsidies and support, select indicators, fiscal years (FY) 2016–22 / Screenshot

An increasingly common trope among backers of green energy is that renewable resources are now ready for prime time and can out-compete traditional fuels like coal, natural gas, and nuclear in the marketplace. Contrary to those claims, official government data depicts that those sources are hugely dependent on taxpayer largesse.

The report only examines FY2016 through FY 2022. As such, it does not account for the passage of the Inflation Reduction Act, which is expected to ladle an additional $1.2-$3 trillion worth of taxpayer gravy on top of wind and solar producers and other green endeavors. It also excludes state and local subsidies, which would almost certainly weight the analysis even further toward renewables in a state like Colorado.

The central tenet of any sensible free-market energy policy has to be a level playing field where generation sources compete with one another on cost and value provided to the grid, allowing consumers to respond to unadulterated price signals to arrive at the most efficient energy portfolio.

Instead, what we face is an energy landscape distorted by a combination of subsidies and mandates that greatly advantage some resources (intermittent renewables) over others (fossil fuels and nuclear) to the detriment of taxpayers and the long-term stability of the electric grid.

The so-called energy transition is anything but market-driven.