by Jon Caldara

Seeing is believing. So, it’s no wonder many in government prefer to work in the dark.

It’s not just that they don’t want us to know what they’re fully doing. They don’t want us to know what we’re fully paying. The reason for this emotional manipulation is clear. If the cost of government is hidden into the cost of our daily lives, we feel like we’re not paying as much as we really are.

As the state legislative session gears up our governor will try to get you to feel you’re not paying a massive tax called the Hospital Provider Fee. He, in concert with everyone who wants to increase taxes in every conceivable way except actually asking voters first, will pressure the legislature, via the new senate president, to embrace this dark money ploy.

This is nothing new. Colorado is chalk full of schemes to turn your tax money dark.

One of the biggest emotional manipulations is employee withholdings. Why in the world is it our employer’s job to collect our taxes? Imagine how you’d feel about your money going to government if you had to write out a check every month along with your other bills. And you think you gripe about your cable bill?

At least your withholdings show up on your paystub, but of course you never look at your electronic paystub (and you know it). Most employees don’t even know, no less feel, that half of their FICA taxes are paid by their employer. Why not give everyone a 7.5 percent raise and let workers pay their own full amount to the state? The answer is obvious.

Doesn’t it feel great when you talk to friends on the east coast and find they pay so much more for their home’s property tax? Thank our “Gallagher” law for giving you the illusion you pay less. It shifts the property tax burden from your home to commercial properties, which pay about three and a half times more.

But businesses don’t pay taxes. People pay taxes. Businesses raise the price of their goods and services to cover their tax expenses, like any other expense. So, when King Soopers pays three and a half times the property tax you do, they just raise the prices of the food we buy. This is evil genius! You vote to raise your home’s mil levy “for the children,” not connecting that you’re raising your food prices (along with everything else).

If you spend the night in a Colorado hospital you’re paying a hidden bed tax which goes to Colorado’s Medicaid system. By state law hospitals aren’t allowed to break out this charge on your bill.

Think about that a second. The state is using the force of law to keep you from knowing what you are being taxed. So, your anger goes to the hospital.

Interesting that every other state calls this ploy a “Hospital Provider Tax” or a “Bed Tax.” Colorado is the only state to call it a “fee.” This leads us to the greatest dark money scam of all.

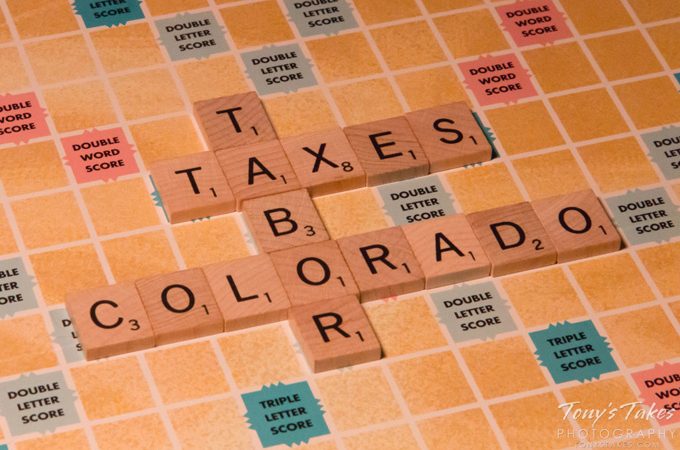

Our Taxpayer’s Bill of Rights requires that we get to vote on raising taxes or debt. But our state Supreme Court, which seems to have a jihad against TABOR, ruled all government has to do is label a tax a “fee” and it doesn’t have to go to a public vote. It can go dark when the politicians wish.

So now over half, over half, the money we Coloradans pay to the state is dark money which falls outside the bounds of TABOR. Conveniently, this means they don’t have to ask us when they create a new “fee,” nor ask us to keep excess revenue when it goes over TABOR limits.

That’s exactly what the governor hopes happens to this Hospital Provider Fee, some $800 million a year and growing. He wants the legislature to turn it dark, away from we voters and away from our prying eyes.

This article originally appeared in the Denver Post, January 7, 2017.