By Henry Zhang

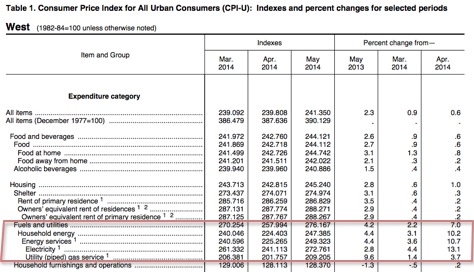

On June 17th, the Bureau of Labor Statistics (BLS) released its monthly consumer price index report. This included statistics regarding consumer prices in May 2014 and year-to-year inflation. Of note is that in the Western Region[1], from May 2013 to May 2014, electricity prices rose 2.8 percent and total energy prices rose by 3.1 percent.[2] Compare those figures to 2.3 percent increase in average consumer prices over the same time period. In fact, according to the Denver Business Journal, the year-to-year price gain in energy was tied with medical care for the largest price gain of any major category used to calculate inflation.[3]

(Here is a screenshot of the relevant BLS Western Region data. Energy prices are boxed in red)

Also from the Denver Business Journal article:

“The monthly increase [in the West] was largely influenced by higher prices for electricity,” BLS said. “Overall, energy costs advanced 4.6 percent over the month.”

Ten of the 13 states that comprise the BLS’ Western Region have some sort of renewable portfolio mandate over the next 15 years. This means that the state must generate a certain proportion of its electricity from renewable sources.[4] For states like Colorado that have been endowed with plentiful coal reserves, this requires replacing electricity from coal, which is relatively inexpensive, with electricity from wind and solar, which is relatively expensive. This, in turn, leads to higher electricity prices, which hurt businesses and consumers alike and can “inflict significant harm on the state economy.” [5]

On a national level, where 37 out of the 50 states have enacted renewable portfolio standards or goals, consumer prices rose 2.1 percent from May 2013 to May 2014 while electricity prices rose 3.6 percent and total energy prices rose 3.3 percent. For the US, like for the Western Region, energy prices experienced the largest percentage increase of all of the major consumption categories used to calculate inflation.

From 2004, when Colorado’s Renewable Portfolio Standard (RPS) was passed, to 2012, the latest year for which data is available, the average retail price of electricity for all sectors increased from 6.95 cents per kilowatt-hour (kWh) to 9.39 cents per kWh, a 35 percent increase.[6] This is equivalent to a 3.76 percent average annual increase. For residential consumers of electricity, the retail price rose from 8.42 cents per kWh in 2004 to 11.46 cents per kWh in 2012. This is a 36 percent increase, equivalent to an average annual increase of 3.85 percent. In the eight years after the RPS was passed, both figures for the annual growth rate in the price of electricity are greater than the average rate of inflation.

For comparison purposes, in the eight years leading up to 2004 (1996-2004), average retail electricity prices only rose 15 percent, from 6.05 cents per kWh to 6.95 cents per kWh. This is an annualized growth rate of 1.73 percent. What more, for residential consumers, the annualized growth rate from 1996 to 2004 was just 1.46 percent. Thus, in the eight years before the RPS was passed, both figures for the annual growth rate in the price of electricity are less than the average rate of inflation. For a typical Colorado household,[7] which spends around $1065 per year on electricity,[8] the difference between an annual 3.85 percent rate increase and an annual 1.46 percent rate increase is an extra $270, per household, spent just on electricity over the course of 10 years. Furthermore, this number is much lower than the true cost of the RPS to Colorado households. It doesn’t take into account the billions of taxpayer dollars that have gone to the energy sources, like wind and solar, which contribute to the rapid rise in electricity prices.

Affordable energy and electricity prices are the bedrock of a strong, healthy economy. Increases in the price of electricity that outpace inflation and real income growth squeeze the spending power of all consumers. Ordinary people like you and me need affordable, dependable electricity for a myriad of purposes that enhance our standard of living. Businesses need a steady electricity supply to produce the goods and services that we consume. A justification of the cost of rapidly increasing electricity prices would require more than the rhetoric of environmental benefits. It would require clear evidence, from detailed, rigorous analyses, that the added value of environmental benefits exceeds the lost jobs and economic malaise caused by higher electricity prices.

Henry Zhang is a Future Leaders summer intern. He is a rising sophomore at Swarthmore College in Pennsylvania, majoring in mathematics and economics.

[1] The Western region consists of Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming (link)

[3] Mark Harden, Denver Business Journal. “Biggest annual price gain since 2012 in Colorado, the West” (link)

[4] Database of State Incentives for Renewable Energy (DSIRE) map (link)

[5] Heartland Institute study on Colorado’s RPS (link)

[6] Data from Energy Information Administration (EIA) (link)

[7] US Census Bureau: Colorado Quick Facts (link)

[8] 775 kWh/month * 12 months/year * 11.46 cents/kWh * (1.0385/1.0146)10 = $1325, which is $270 greater than $1065