Government does a variety of things that make health coverage more costly.

Now that the legislature has empaneled a commission (disclosure, I sit on the commission as health care economist) to look at Colorado health care cost drivers, we can hope that it will encourage officials to take a hard look at what the state and federal government can do to reduce the unnecessary costs that they impose on everyone who buys health care.

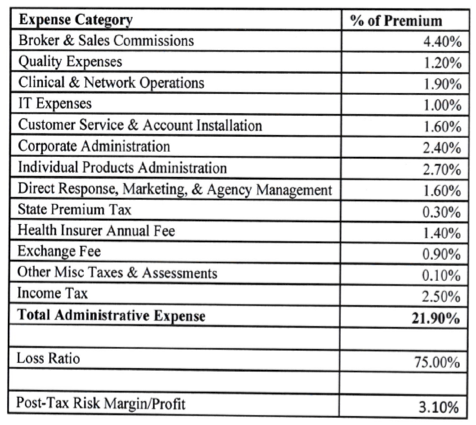

How big are the cost burdens imposed by government? Below is a table from a 2013 Humana filing with the Colorado Department of Insurance for a plan sold in 2014.

Humana expected a profit of 3.1 percent from selling this particular plan on the Colorado health benefits exchange. The burden imposed by government via direct taxes and fees was expected to be 5.2 percent. It exceeded both expected profit and every other category of administrative cost.

Using taxes and fees on health coverage to generate revenue increases the cost of health coverage. If health coverage is so important that a law is needed to force people to purchase it, and if cost increases are so dangerous that the Colorado legislature saw fit to spend $400,000 of your tax dollars studying them, then the least officials can do is end the cynical practice of taxing the premiums that everyone is forced to pay.

This is just one example of how government behavior adds to health care costs. It shows why any effort to understand health care cost drivers in Colorado must first understand how existing government programs, statutes, and regulations affect health care costs, and what government can do to reduce them.

Linda Gorman directs the Independence Institute’s health care policy center.