IB-2012-D (September 2012)

Author: Ben DeGrow

PDF of full Issue Backgrounder

Scribd version of full Issue Backgrounder

Overview

In 2012 at least 26 Colorado school districts are asking local voters to approve various tax increases, including mill levy overrides to fund operating costs, bond issues with local funds or state matching grants to pay for capital construction or renovation projects, and even a sales tax hike. Notably, five of Colorado’s nine largest school districts have placed property tax hikes on the fall 2012 ballot: Jefferson County R-1, Denver Public Schools, Cherry Creek Schools, Aurora Public Schools, and St. Vrain Valley R-1J.

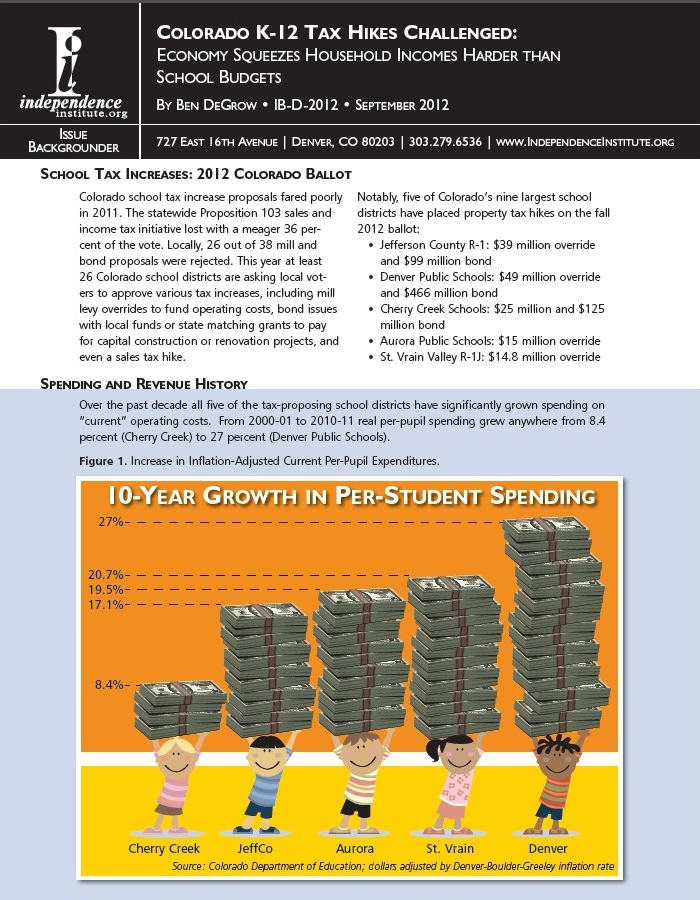

Over the past decade all five of the tax-proposing school districts have significantly grown spending on “current” operating costs. From 2005 to 2010, median household incomes in all five counties covered by the five districts fell short of per-pupil school tax revenues. Asking voters to increase property taxes this year may not be an easy task.