May state legislative applications limit an Article V convention? Subject, yes; specific language, probably not

- September 12, 2013

Increasing state spending as population grows assumes that larger populations require more government services. This may not always be the case, but it at least refrains from taxing people simply because they work harder.

READ MORE

by Jon Caldara The Taxpayer’s Bill of Rights does NOT limit tax and spending. In fact, TABOR allows Colorado governments, all 3,700 of them, to rake in and keep unlimited amounts of money and heap unlimited amounts of debt upon your children. It requires you merely be asked first. That’s it. Ask first. You won’t

READ MORE

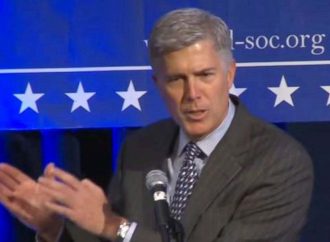

The Independence Institute has specific reason to celebrate the nomination of Judge Gorsuch to the Supreme Court. In 2011, a group of anti-TABOR plaintiffs sued in Denver federal court, arguing that TABOR violated the U.S. Constitution because it was inconsistent with the Constitution’s guarantee that every state have a “republican form of government.” (Kerr v.

READ MORE

Fred Holden (below) and Rob Natelson, both Senior Fellows at the Independence Institute, talk about the famous Colorado Taxpayer’s Bill of Rights in this interview.

READ MORE

Rules limiting the legislature’s ability to tax, spend, and/or incur debt appear in the U.S. Constitution and in the constitutions of almost all states. But probably the most famous and most controversial is Colorado’s “Taxpayer’s Bill of Rights,” or TABOR. TABOR gives the people, voting in referenda, the final say on most state and local

READ MORE